unrealized capital gains tax warren

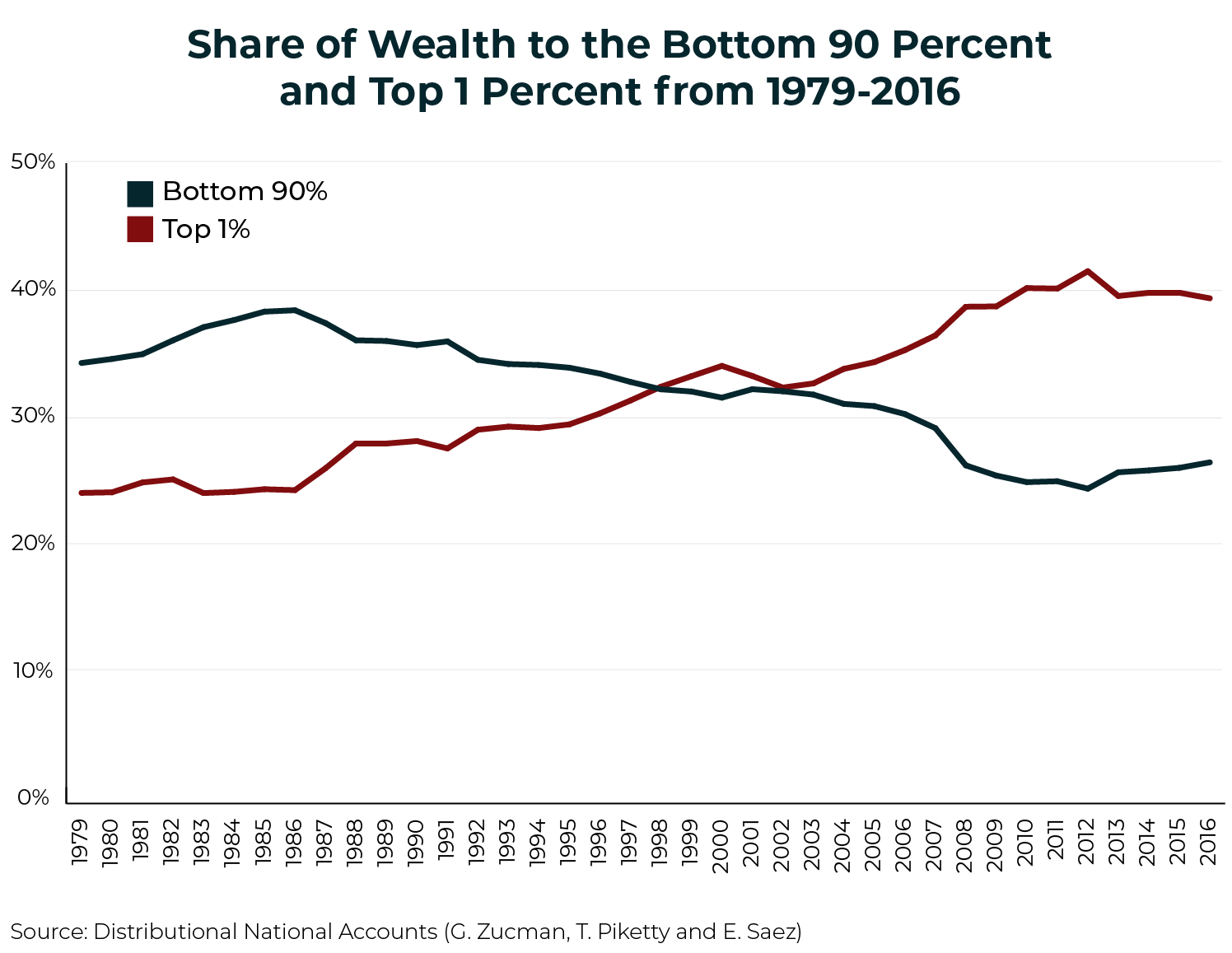

The Problems With an Unrealized Capital Gains Tax. Almost all households 98 in the top 10 have some sort of unrealized gains according to most recent Federal Reserve data from 2019.

Democrats Are After Your Money With Wealth Taxes Even A Tax On Unrealized Gains Mish Talk Global Economic Trend Analysis

26 2021 in Washington DC.

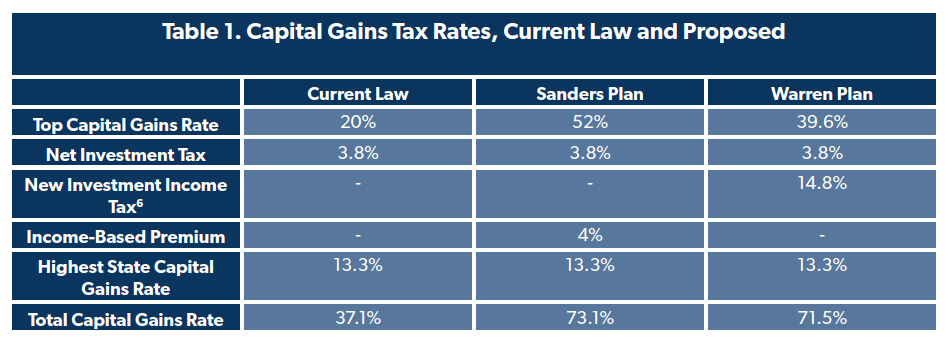

. Warren a front-runner in the 2020 presidential race is proposing a 2 tax on household net worth above 50 million and a 6 tax on net worth over 1 billion. An Obama Administration plan to tax capital gains at death would have raised about 200 billion during the 10-year budget window. Thats the attitude at least of some progressive lawmakers like Elizabeth Warren and Alexandria Ocasio-Cortex AOC who famously wore a dress to the Met Gala with Tax.

Unrealized capital gains. Warren says her mark-to-market tax. In 2011 superstar investor Warren Buffett made headlines not for his investment recommendations but for his opinion that.

Elizabeth Warren D-Mass and Ron Wyden D-Ore speak to reporters about a corporate minimum tax plan at the US. Will the Unrealized Capital Gains Tax Proposal Apply to Most Investors. Now that weve looked at what a tax on unrealized capital gains could be like its time to point out three significant.

Answer 1 of 2. An unrealized capital gains tax on corporate assets could hit those with real estate especially hard but companies with bitcoin also come to mind. If you hold an asset for less than one year and sell for a capital gain the.

Actually there is absolutely no way to do what she suggests. Warren Buffett taxing capital income is a bad idea. Is expected to lose almost 42 billion in tax revenue this year from the exclusion of.

The value of unrealized gains is based on a snapshot of the underlying asset at a specific point in time. A tax on an increase in unrealized capital gains is only on the most stretched of interpretations a tax on income. The tax would apply to 1 million of that 2 million gain due to the exclusion.

Democrats seem to have nixed the idea of taxing returns on unsold stock and other assets favoring other ways to raise revenue as part of a nearly 2. The amount youll pay in capital gains taxes depends primarily on how long you held an asset. This tax is similar to taxes that have long been supported by progressive lawmakers like Sens.

Elizabeth Warren D-Mass and Bernie Sanders I-Vt. When a permanent income tax was. Rachel Warren Brian Withers and Trevor Jennewine 11162021 NATO Says Missile That Hit Poland.

Warren Buffett Taxing Capital Income Is A Bad Idea The Hill

Wealth Tax Proposals From Warren And Sanders What You Should Know Itep

Wealth Tax Proposals From Warren And Sanders What You Should Know Itep

Serge Egelman On Twitter If You Can Use Unrealized Capital Gains As Collateral For A Loan A Reasonable Person Should Conclude That Those Gains Have Effectively Been Realized This Is An

Wealth Taxes And Their Impact On Entrepreneurs Foundation National Taxpayers Union

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

A Fiscal Analysis Of Elizabeth Warren S Medicare For All Plan By Avik Roy Freopp Org

Biden Is Trying To Pass A Wealth Tax Again It Could Be Unconstitutional

Estate Tax Gift Tax Learn More About Estate And Gift Taxes

What The Wyden Proposed Tax On Unrealized Capital Gains May Mean For You

Propublica Shows How Little The Wealthiest Pay In Taxes Policymakers Should Respond Accordingly Center On Budget And Policy Priorities

Why Congress Shouldn T Rush To Enact Poorly Conceived New Taxes To Fund Spending Spree The Heritage Foundation

Short Term And Long Term Capital Gains Tax Rates By Income

Proposed Tax On Billionaires Raises Question What S Income The New York Times

Opinion Elizabeth Warren S Wealth Tax Might Sound Like Nothing But The Numbers Aren T Small The Washington Post

Wealth Tax Elizbeth Warren Bernie Sanders Wealth Tax Proposals

Want To Tax The Rich Don T Mark To Market Capital Gains Tax Unrealized Gains At Death Instead

Senator Warren S Nutty Idea To Tax Unrealized Capital Gains International Liberty

Wyden Details Proposed Tax On Billionaires Unrealized Gains Roll Call